child tax credit october 2021

Census Supplemental Poverty Measure report shows that the 2021 child tax credit reduced child poverty by 46. More than 9 million people are still owed money from the IRS.

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa

October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion.

. All eligible families could receive the full credit if. The fourth advance child tax credits payment will land in bank accounts and as paper checks on October 15. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now.

Find out if you qualify for the Child Tax Credit in 2021 and how to claim it on your taxes. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The new 2021 US.

Many in this group may be eligible to. The Child Tax Credit reached 611 million children in. From April 2020 to December 2021 the federal government made direct COVID-19 stimulus payments to.

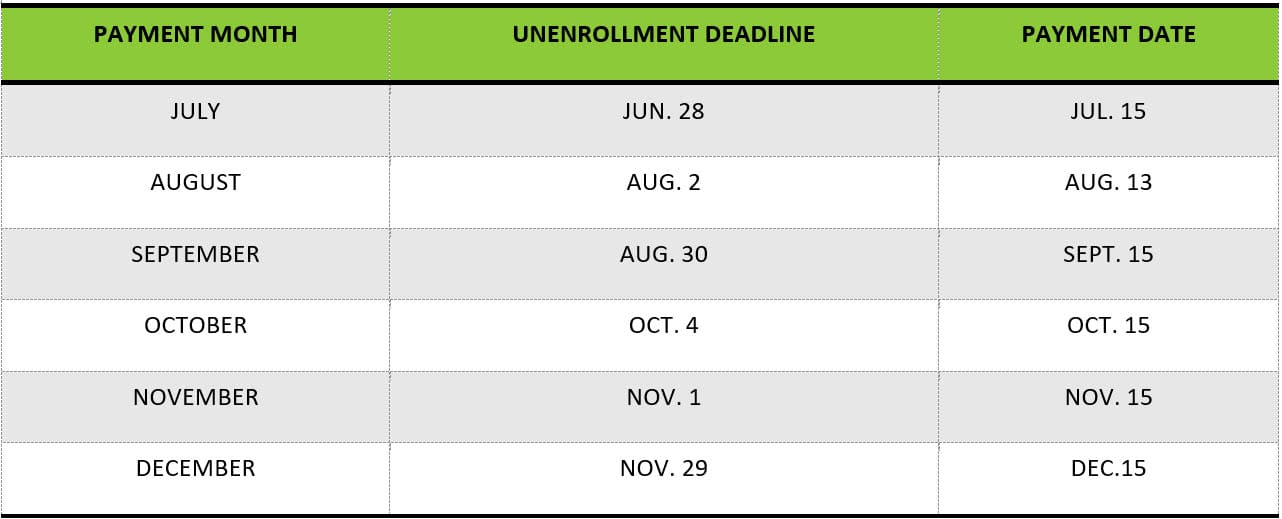

We explain the key deadlines for child tax credit in October. As part of the. IR-2021-201 October 15 2021.

Change language content. Changes in income filing status the birth or. The monthly 2021 Child Tax Credit payments were based on what the IRS knew about you and your family from your 2019 or 2020 tax return.

The IRS has confirmed that theyll soon allow. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. Most families are eligible to receive the credit for their children.

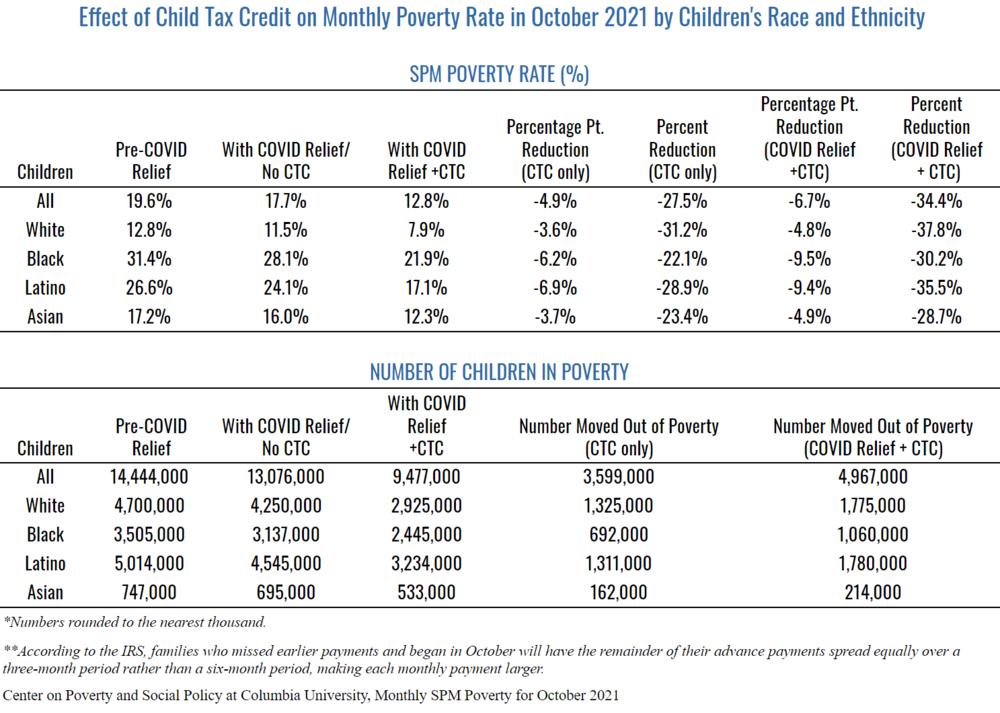

You received advance Child Tax Credit payments only if you used your correct SSN or ITIN when you filed a 2020 tax return or 2019 tax return including when you entered. The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021. The American Rescue Plan Act ARP enhanced the CTC for 2021 considerably creating the largest US.

If you havent filed your 2021 taxes you might be owed thousands from. The credit enabled most working families to. For families with qualifying children who did not turn 18 before the start of this year the 2021 Child Tax Credit is.

3600 for children ages 5 and under at the end of 2021. The monthly payments were up to 250 or 300 per child for a period of. The IRS will soon allow claimants to adjust their.

For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from a few days. Child tax credit ever. 21 hours agoNew data proves how well it worked.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Have been a US. Who can get a COVID-19 stimulus payment or a Child Tax Credit.

3000 for children ages 6. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual. Advance payments of the enhanced child tax credits were sent to people from July to December 2021.

Households making less than 12500 and married couples making under 25000 can turn in a simplified tax return via a website the federal government built for the child tax credit payments. Taxpayers who requested the six-month filing extension should complete their tax returns and file on or before the October 17 deadline. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit.

1 day agoOctober 14 2022 1224 PM. The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger.

Expanded Child Tax Credit Continues To Keep Millions Of Children From Poverty In September Columbia University Center On Poverty And Social Policy

Child Tax Credit Advanced Payments Information Bc T

Are Black And Latine Families With Babies Feeling Relief From The Child Tax Credit October 2021 Frank Porter Graham Child Development Institute

Monthly Payments For Families With Kids The 2021 Child Tax Credit United For Brownsville

When Is The Next Child Tax Credit Payment

October Child Tax Credit Payment Kept 3 6 Million Children From Poverty Columbia University Center On Poverty And Social Policy

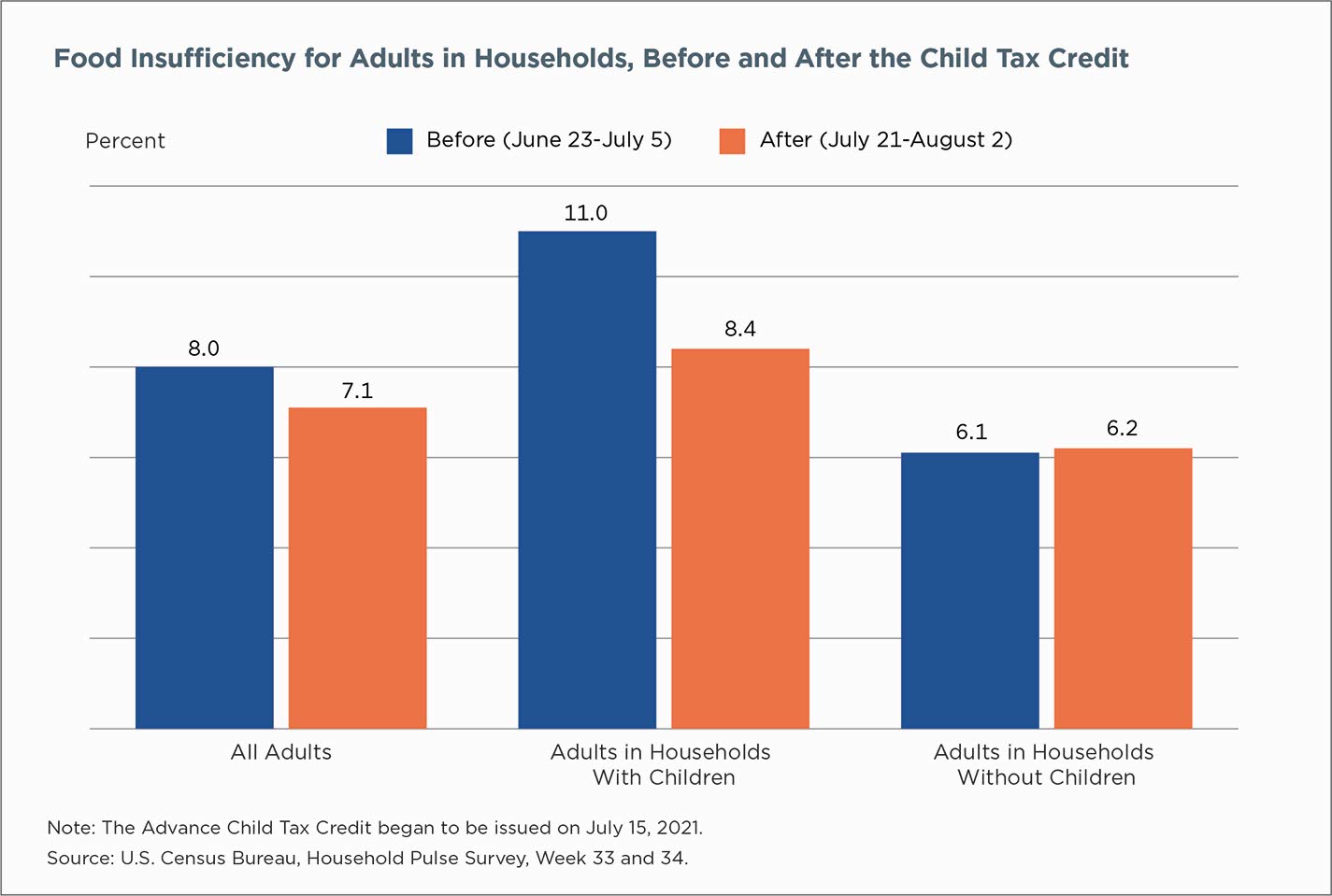

Families Saw Less Economic Hardship As Child Tax Credit Payments Came

Advance Child Tax Credit Update October 12 2021 Youtube

You May Be Surprised By Cuts In October Child Tax Credit

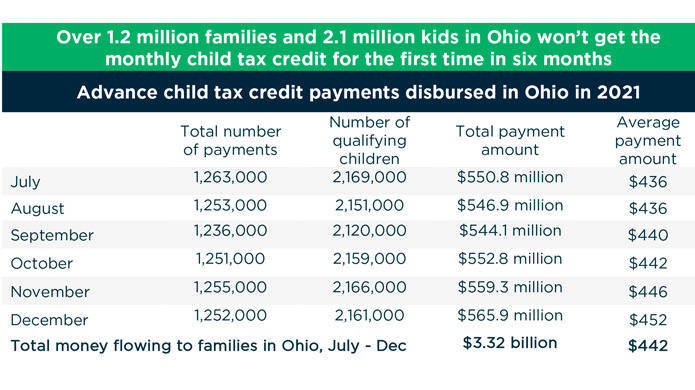

What S At Stake For Families As The Monthly Child Tax Credit Payment Ends Ohio Capital Journal

E C Financial Services And Tax Preparation Child Tax Credit Expansion When Will The First Checks Get Sent Out We Know The Child Tax Credit Payments Will Begin Arriving In July But

What Families Need To Know About The Ctc In 2022 Clasp

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

Make Updates To Your Advance Child Tax Credit Payment By The November 29th Deadline Tas

Child Tax Credit August 2021 Check Vs Direct Deposit Youtube

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

Sign Up For The Child Tax Credit Before November 15 2021 Chinese American Planning Council

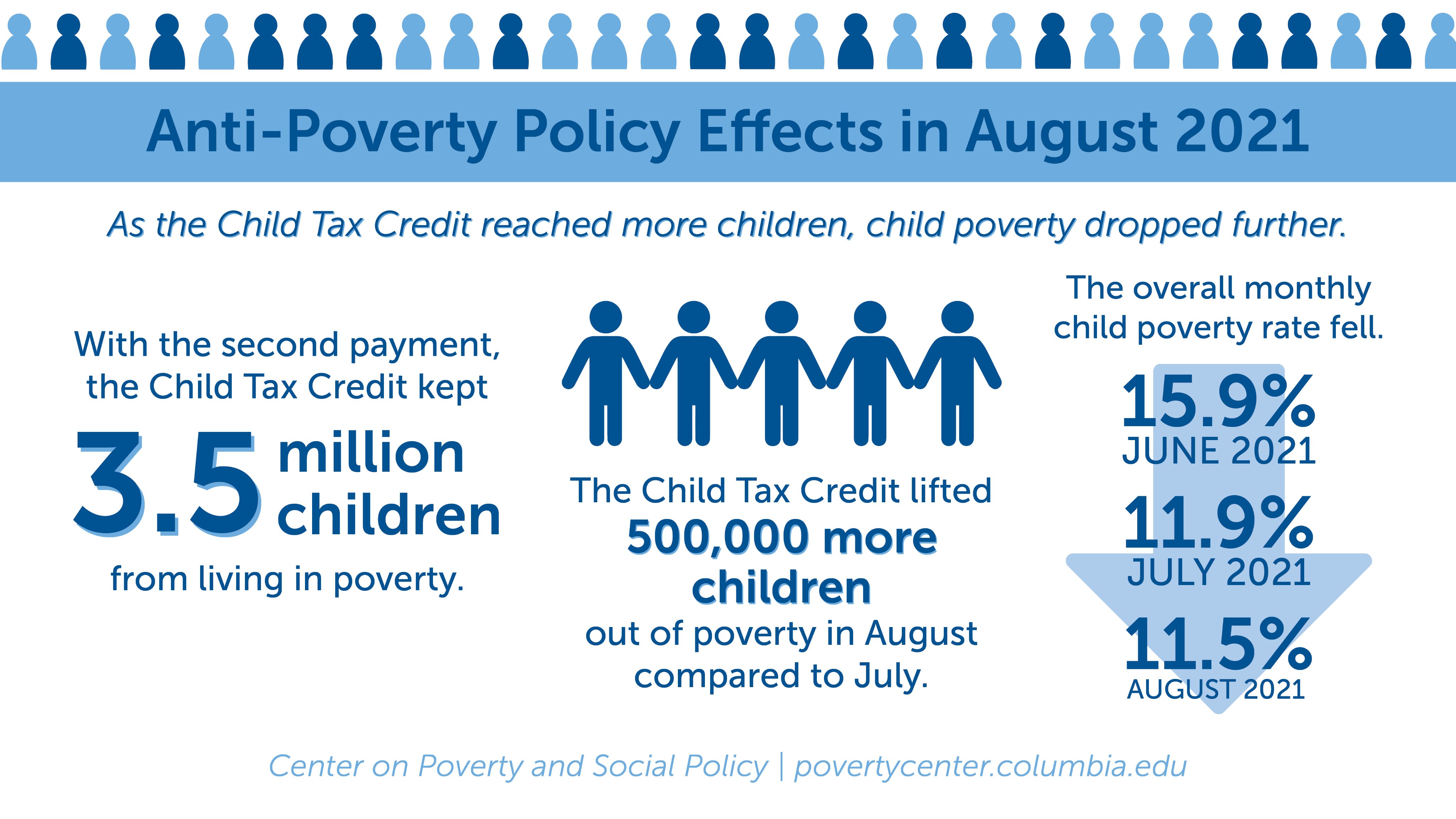

Center On Poverty Social Policy Cpsp On Twitter The Child Tax Credit Continues To Deliver In August 3 5 Million Children Kept Out Of Poverty 500 000 More Children Kept Out

Child Tax Credit Update A Portal To Update Bank Details And Facilitate Payments Marca